|

<< Click to Display Table of Contents >> Georgia |

|

|

<< Click to Display Table of Contents >> Georgia |

|

Frazer tries to provide programming to tailor the functioning of the system to the laws of the state that you are operating in. These may include specific tax rates for various municipalities, state specific forms or interest and late fees limits Because of this, the functioning of the system may be different from one state to the next.

Georgia Department of Driver Services

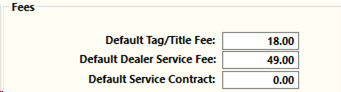

Default Fees

Frazer Provides a System Option to set your Default Government Fees. Check with your local agency to verify the correct amount for your area.

Special programming for Georgia:

TAVT - Title Ad Valorem Tax

Motor vehicles purchased on or after March 1, 2013 and titled in this state are exempt from sales and use tax and annual ad valorem tax, also known as the "birthday tax." These taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the title ad valorem tax fee ("TAVT"). The fair market value is the taxable base of the motor vehicle. The manner in which fair market value is determined depends on whether the motor vehicle is new or used.

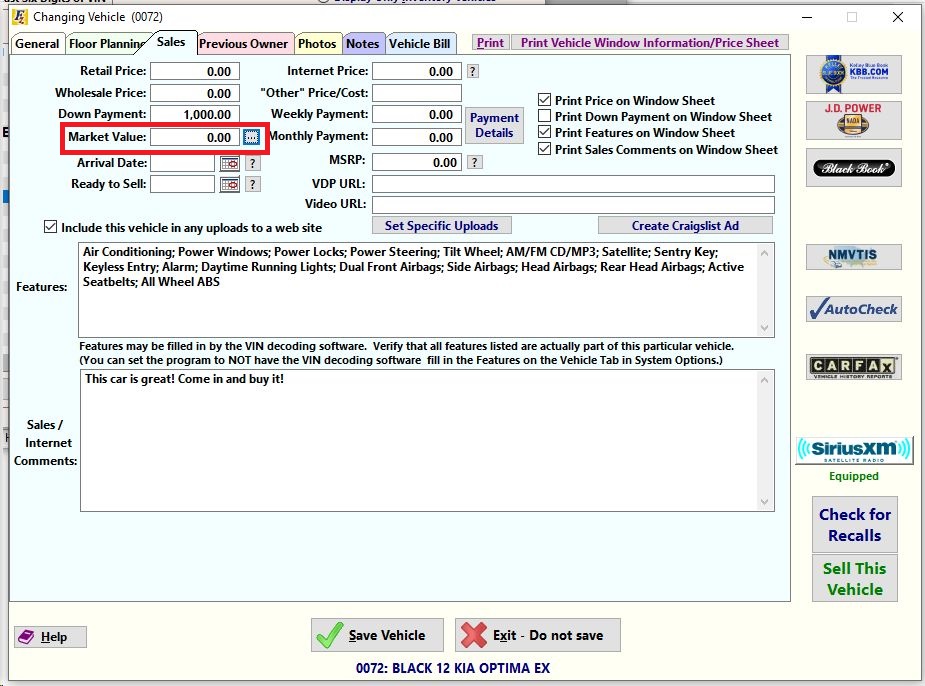

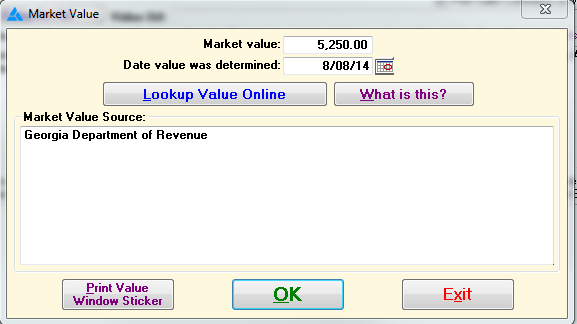

When you add a vehicle to the system, Frazer can check with the Georgia Department of Revenue and retrieve the fair market value from their database. It will be saved on the vehicle screen, on the sales tab.

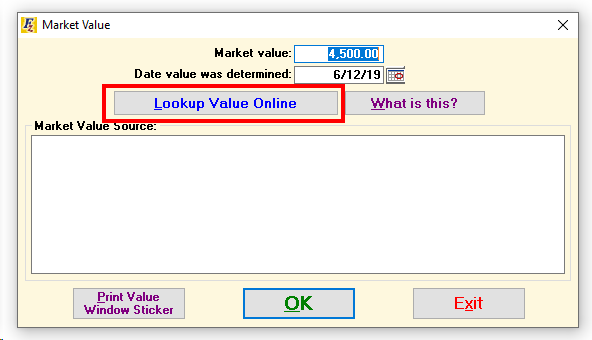

Clicking the small box will tell you, the date the value was determined, and the source...and allow you check to check for an updated value by clicking "Lookup Value Online."

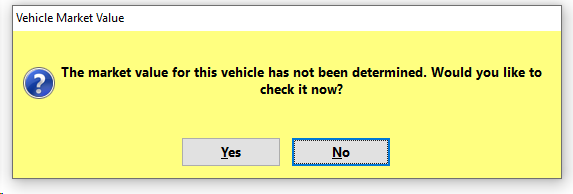

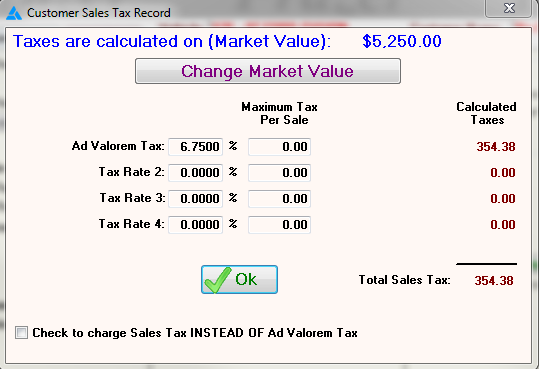

When you attach a vehicle to a sale...Frazer will give you the tools to check the market value...and then calculate the taxes based on that value.

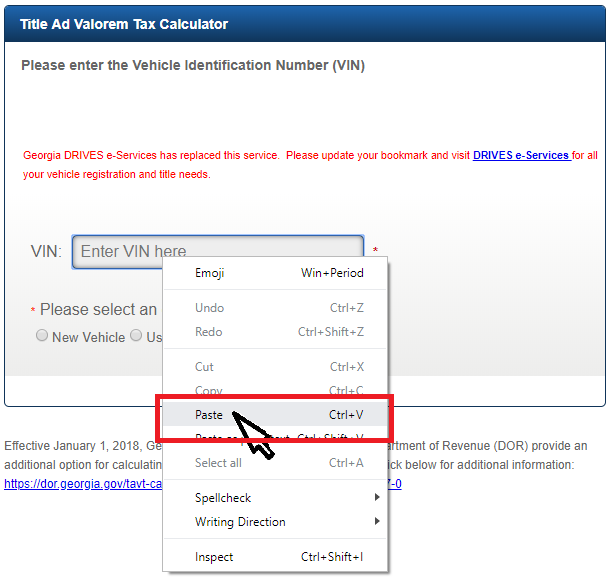

After clicking the link to visit the Department of Revenue's website, right-click in the box to "paste" the vin (Frazer automatically copies the VIN to the Windows clipboard) and answer the associated questions.

Frazer will then calculate the TAVT based on the value.

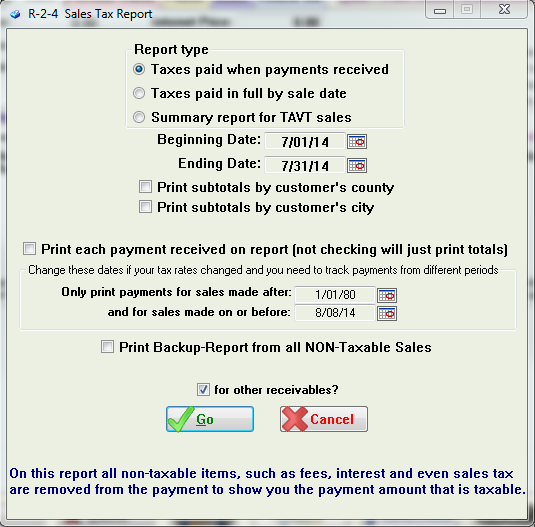

The R>2>4 Sales Tax Report contains an option to allow you to print a summary of your TAVT sales.

Georgia Pro-Rata adjust

The “Pro-rata adjust” transaction is only used in Georgia, and is only used when you write off an account and you plan on pursuing any deficiency balance with that customer. Case law (see below) in Georgia states that you cannot use the Rule of 78’s method to calculate any deficiency balance owed to you when you write off a customer. If you had been using the Rule of 78’s method to earn interest then accounting rules that you must continue to use that method when you write the account off. However, this will result in a deficiency balance that would be higher than if you had been earning interest using the pro-rata method. The Frazer system will then adjust the customers balance by the difference between if you had been earning interest using the pro-rata method and the Rule of 78’s method you are actually using. We call this adjustment to the customers balance “Pro-rata adjust”.

Case law means that it is not a law on the books, but enough judges have ruled this way that it is now the de facto law. One of the original cases that resulted in this was in 1974 in Cook vs. First National Bank. Case number 130 Georgia Appeals 587. Multiple cases have also been decided since then, all requiring the pro-rata method when determining a deficiency balance.