|

<< Click to Display Table of Contents >> Florida |

|

|

<< Click to Display Table of Contents >> Florida |

|

Frazer tries to provide programming to tailor the functioning of the system to the laws of the state that you are operating in. These may include specific tax rates for various municipalities, state specific forms or interest and late fees limits. Because of this, the functioning of the system may be different from one state to the next.

Florida Highway Safety and Motor Vehicles

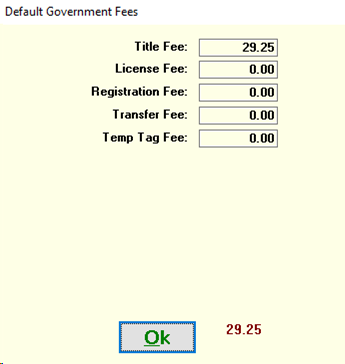

Frazer Provides a System Option to set your Default Government Fees. Check with your local agency to verify the correct amount for your area.

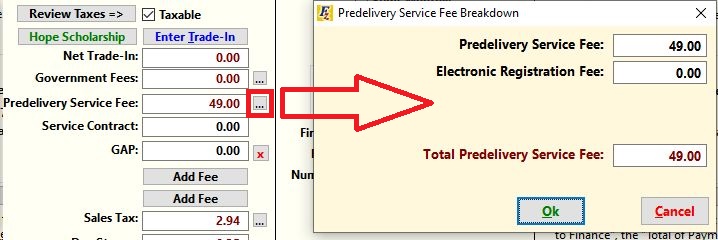

Predelivery Service Fee

Frazer gives you the ability to break out your dealer Service fee into predelivery service fee and electronic registration fee. This menu is available by clicking the "..." button next to predelivery service fee.

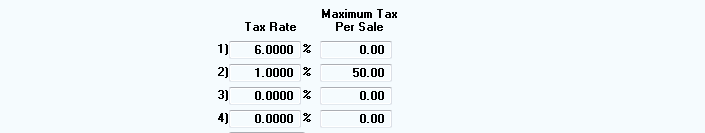

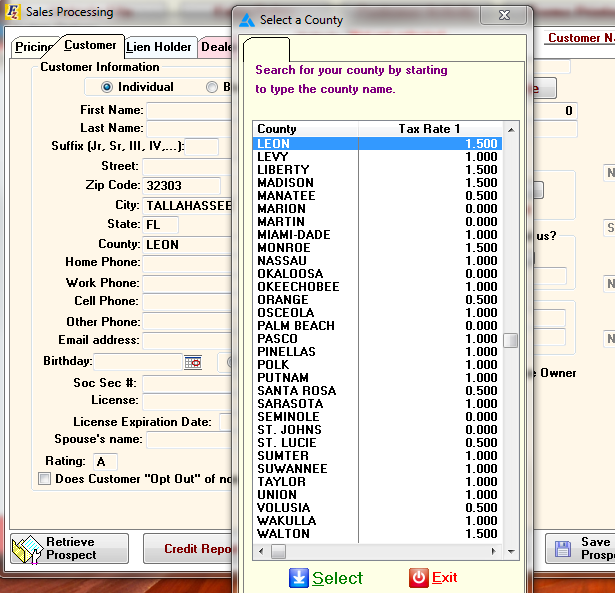

Frazer Tax Rates for Florida are pre-set.

Frazer calculates Sales Tax based on the county where the customer lives. When the customer's zip code is entered, Frazer will update the tax rate automatically. No changes are required in your system options.

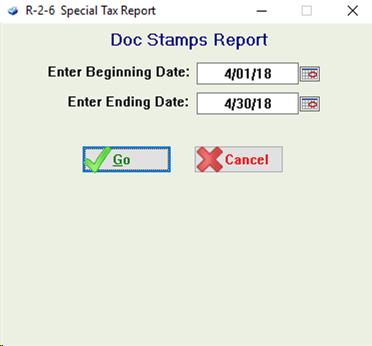

Frazer tracks all Doc Stamps charged to customers. The report is available from Reports >> 2 - Sales Reports >> 6 - Doc Stamps Report. It will print a list of Doc Stamps charged to customers over a specific date range of sales.

The system defaults the Doc Stamp rate to 35 cents per $100. This does not need to be changed.

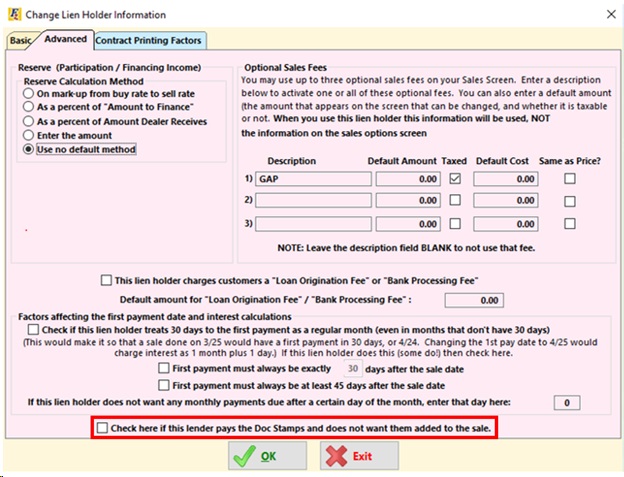

A dealer MUST collect Doc Stamps when they contract the customer. If they do not want to charge them to the customer because the customer is bringing their own money from a bank or CU then they must do a cash sale and attach the proper lien-holder if necessary. OR They can check the checkbox at the bottom of the lien holder's advanced tab.

Pickup Notes - Pickup Note amounts ARE charged doc stamps as are all payments that are due.

Beginning with the 2018-2019 school year, a student enrolled in a Florida public school in kindergarten through grade 12 who has been subjected to an incident of battery; harassment; hazing; bullying; kidnapping; physical attack; robbery; sexual offenses, harassment, assault, or battery; threat or intimidation; or fighting at school the opportunity to transfer to another public school with capacity or enroll in an approved private school under the Hope Scholarship.

The law provides for eligible sales tax contributions from the purchase of a motor vehicle to eligible nonprofit scholarship funding organizations (SFOs). Contingent upon available funds, the SFOs then award the scholarships to eligible students on a first-come, first-served basis.

Beginning on or after October 1, 2018, anyone who purchases or registers a motor vehicle qualifying for the Hope Scholarship Program in Florida may designate $105 of the state sales tax due at the time of purchase or registration to an eligible nonprofit scholarship-funding organization participating in the Program. If the state sales tax due is less than $105, the designated amount would be the state sales tax due.

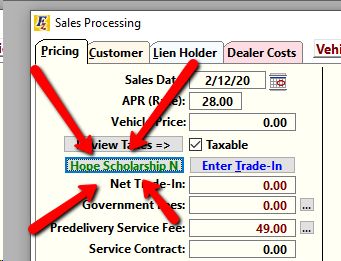

To opt the customer in or out for tracking and printing purposes in Frazer, you can click the Hope Scholarship button underneath the "Review Taxes" button on the Pricing tab of Sales Processing and make a selection.

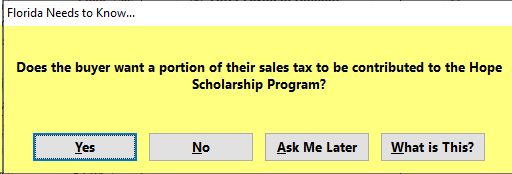

You will be prompted:

If you choose "Ask Me Later" or don't make a selection, you will be prompted again when completing the sale. This will help designate how to handle the taxes on all reports for taxes and write-offs going forward. It will also designate what to print on the DR-HS1 and DR-HS2 from Frazer. (Available as forms in "Print Forms.")

Temporary Tags

This system will store up to two Temporary Tag numbers for each customer. You can add and modify Temporary Tag information on the "Sales" tab in the Vehicle Window. The Temporary Tag Log itself is report R-2-E. In Florida, the tag number will be automatically saved for you in the Temporary Tag Log when you print form HSMV 83091 - Application for Temporary License Plate.