|

<< Click to Display Table of Contents >> Reserve as a Mark-up from Buy Rate to Sell Rate |

|

|

<< Click to Display Table of Contents >> Reserve as a Mark-up from Buy Rate to Sell Rate |

|

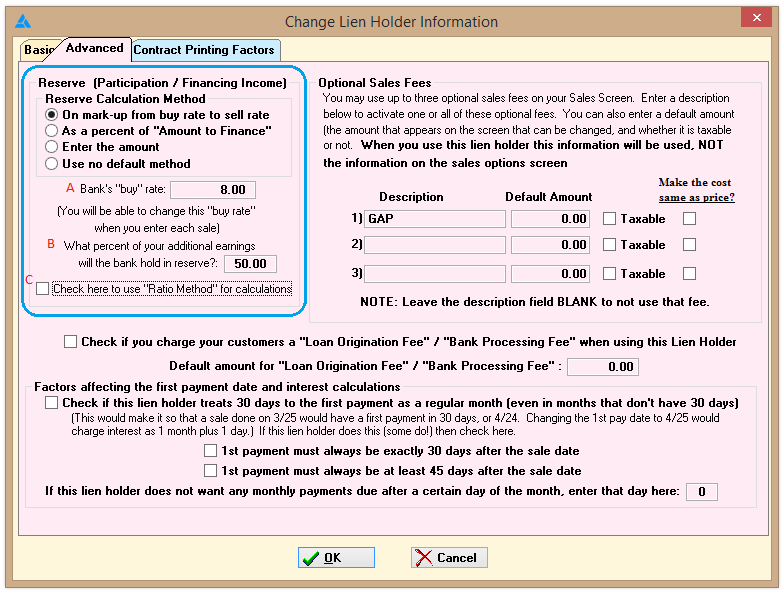

*Setting Lien Holder Defaults :

A. The Interest Rate charged by the Lien Holder.

B. The percentage of the Mark-Up that determines the actual reserve amount.

( C. In some circumstances the bank will require the Ratio Method for Mark-up. NEVER use this unless told to do so by a bank. See As a Mark-Up Using the Ratio Method for details.)

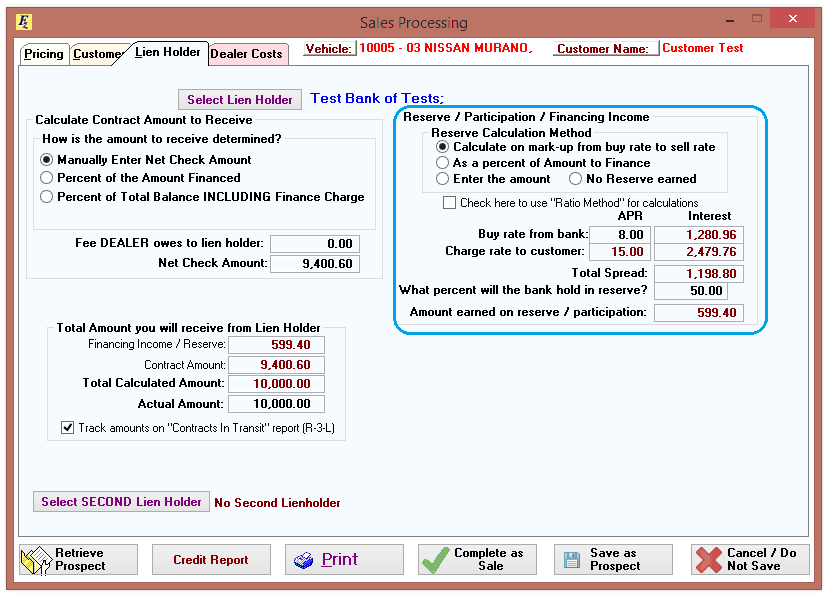

*Below is what the actual sales screen looks like when using the Flat Amount method:

EXAMPLE: This is how Frazer calculates the reserve as a mark-up.

Finance Charge |

$2479.76 (15% APR on a total amount to finance of $10,000.00) |

|

Bank Buy Rate |

The Bank’s Buy Rate in this example is 8%. At an APR of 8% there would be a finance charge of $1280.96 |

|

Sell Rate |

15% (The actual finance charge of $2497.76) |

|

Reserve Rate |

50% (The percent the bank will hold in reserve) |

|

Method |

SellRateFinance – BuyRateFinance = TotalSpread * PercentHeld |

|

CALCULATION |

((15% APR of $10,000) – (8% APR of $10,000)) * 50% |

|

|

($2479.76 - $1280.96) * .5 |

|

|

$1198.80(Total Spread) * .5 |

|

Reserve Amount is |

$599.40 |

|