|

<< Click to Display Table of Contents >> Mississippi |

|

|

<< Click to Display Table of Contents >> Mississippi |

|

Frazer tries to provide programming to tailor the functioning of the system to the laws of the state that you are operating in. These may include specific tax rates for various municipalities, state specific forms or interest and late fees limits Because of this, the functioning of the system may be different from one state to the next.

Mississippi Department of Revenue

4. Sales Tax on Finance Charge

Frazer Provides a System Option to set your Default Government Fees. Check with your local agency to verify the correct amount for your area.

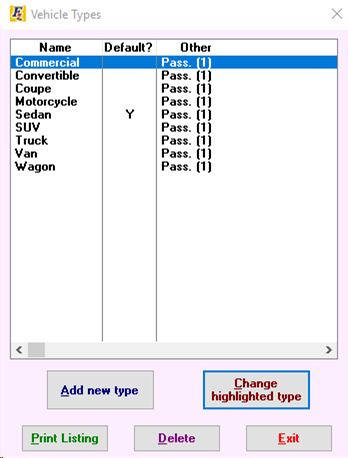

For Dealers in Mississippi, there is additional functionality in the Vehicle Type screen to select a vehicle and change it’s “type” by clicking on the "Change Highlighted Type" button.

This screen is available from Vehicles >> 7 - Vehicle Types

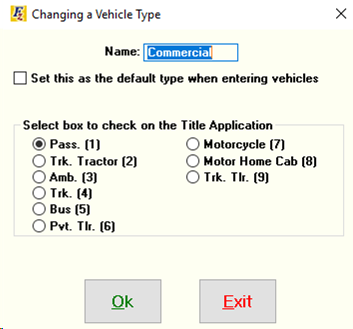

The following screen appears after clicking “Change Highlighted Type”. For this example, when the Vehicle is designated as Mid-Size in the Vehicle file, the ‘Pass. (1)’ box will be checked on the Title Application.

Sales Tax used to be charged on the Finance Charge if the dealer was carrying the note (BHPH). It was not charged on the Finance Charge if the sale was not BHPH (Outside Financing).

Starting July 1, 2014, 2014 Mississippi House Bill 260 went into effect, which makes interest on BHPH sales non-taxable.