|

<< Click to Display Table of Contents >> New Floorplan tab accounting |

|

|

<< Click to Display Table of Contents >> New Floorplan tab accounting |

|

So, you may be asking, how does the floor plan affect the General Ledger? I’m glad you asked!

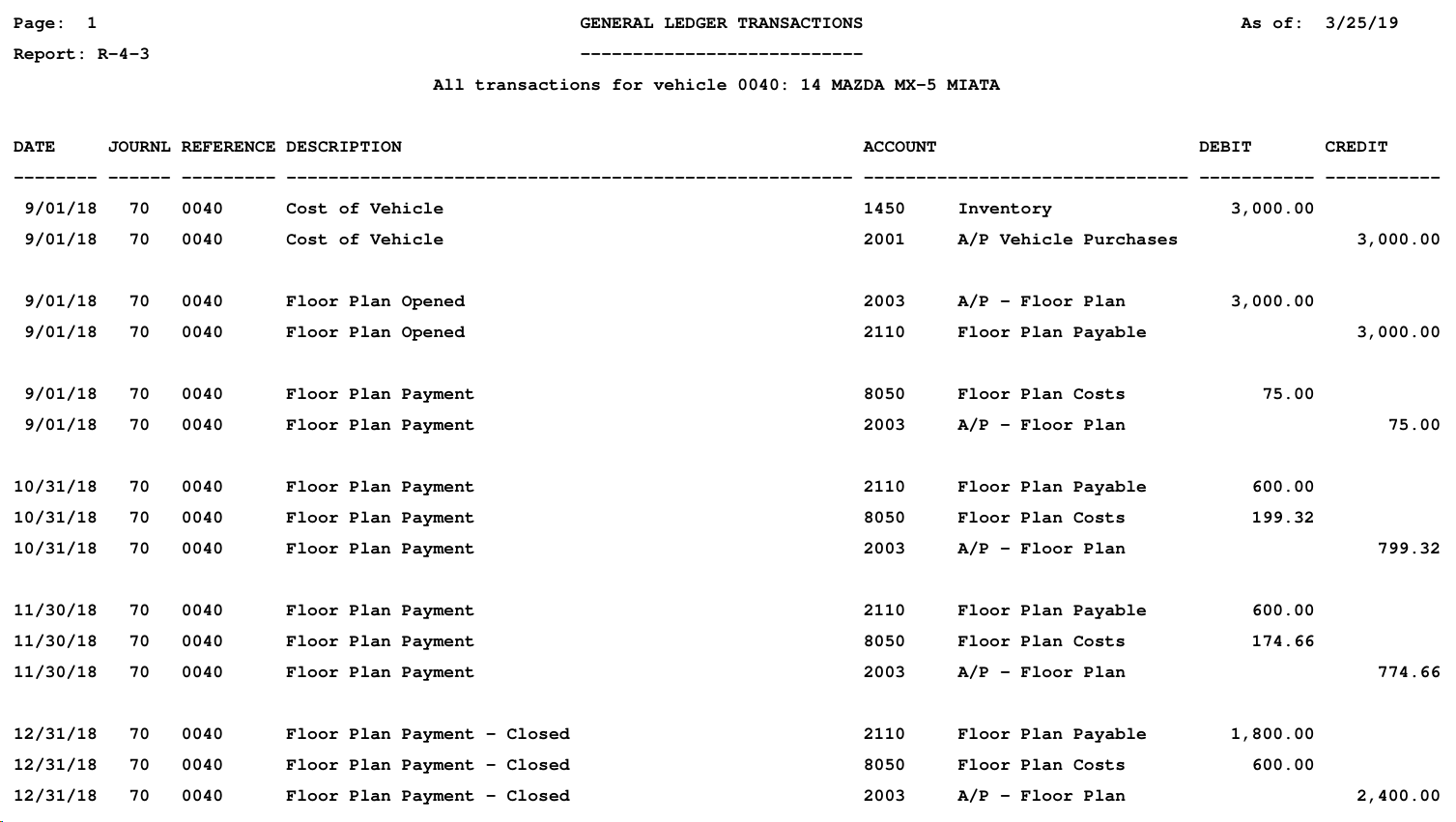

If we run the ![]() report located at the top of the vehicle file, then we can review how the General Ledger is affected with each curtailment.

report located at the top of the vehicle file, then we can review how the General Ledger is affected with each curtailment.

The initial post in our General Ledger is for our vehicle purchase. This post will never be affected by a floor plan being added.

The second post is where our floor plan starts. You’ll notice that the post is debiting account 2003 A/P - Floor Plan and crediting 2110 Floor Plan Payable. What this post is doing is creating the liability for which you will show the deposit from the floor plan company coming into your dealership as well as create the liability that we will pay down as we make curtailments and eventually pay off our floor plan.

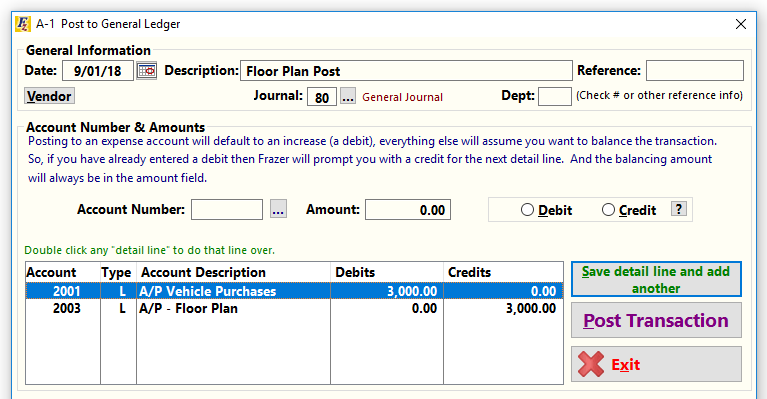

So at this point to complete the “accounting circle” we will need to make the deposit that shows the Floor Plan company covering the cost of the vehicle. For our above example you would need to do a manual post debiting 2001 A/P Vehicle Purchases and crediting 2003 A/P - Floor Plan.

Our manual post (Accounting > 1 - Post to General Ledger) would look like this:

In this example, no money actually exchanged hands, so our post is simply off-setting our two A/P accounts, zeroing both out. As we make payments we’ll begin to pay down our 2110 - Floor Plan Payable account, but more on that in a moment.

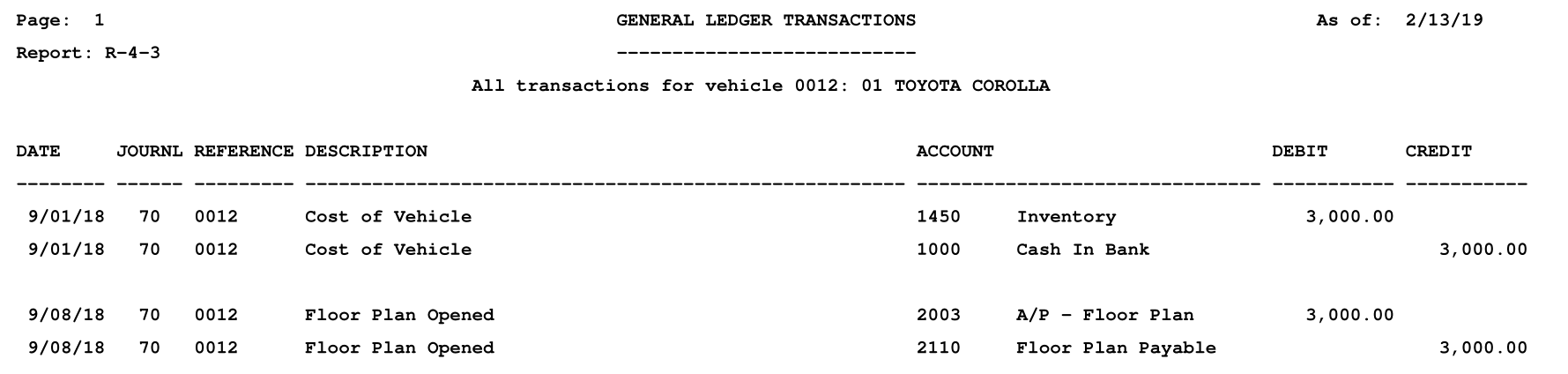

What if I paid my vehicle with a check and then a week later (or any date) floor planned my vehicle?

Great question, let’s start with the G/L for this type of scenario:

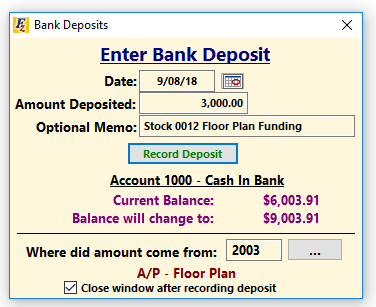

Our manual post would work roughly the same for this scenario. We can do a manual post OR we can show the deposit coming back into the checking account using “Accounting > D - Record Bank Deposits.” Our deposit screen would look like this:

As you can see, our deposit is fairly typical, except that we need to change our account for which the amount came from. This will offset our liability post on our G/L and take account 2003 A/P - Floor Plan to $0 when we receive the deposit from the Floor Plan Company.

Note: When changing the account for where your deposit came from you may get a warning that deposits don’t typically come from anywhere BUT 1010 Undeposited Funds. You can safely ignore this warning. We know what we’re doing!

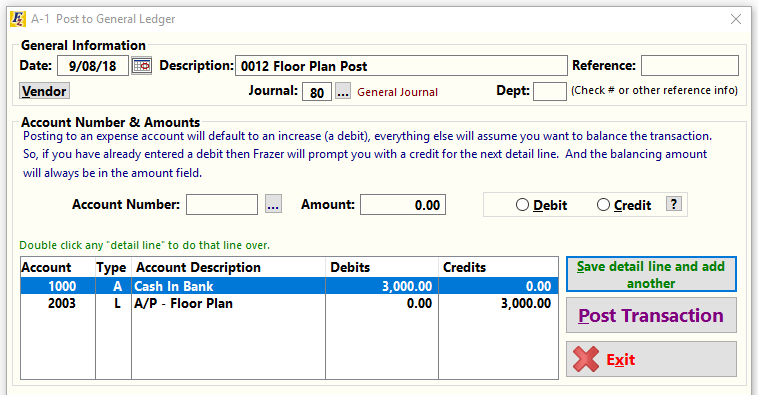

If recording a deposit isn’t your speed (or you originally paid with a different asset), you can also manually post the transaction using “Accounting > 1 - Post to General Ledger”.

Your post would like this:

So what about when I make curtailments? What’s going on with those posts?

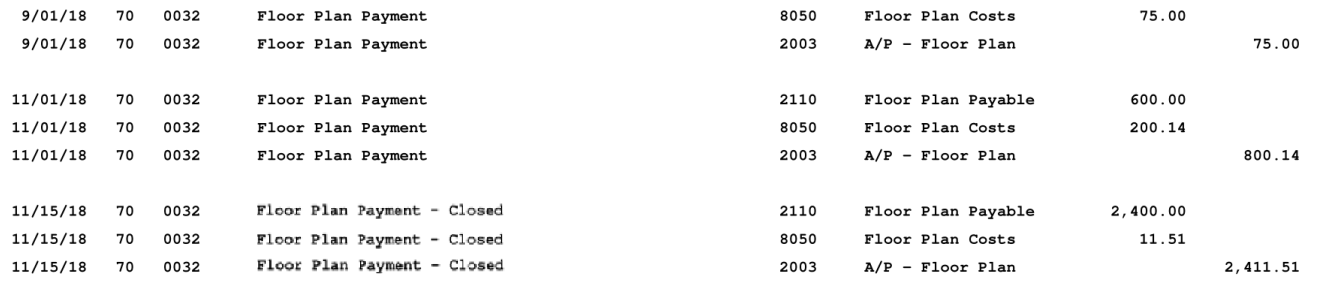

Let’s refresh our memories on what those posts look like:

Our first payment isn’t for a curtailment at all but rather it’s a setup fee that we owe for this floor plan. This is the most simple of all posts. We create a liability (more on this in a moment) and also hit an expense account for income statement purposes.

Our second and third transactions are a tad more complicated as they are for actual curtailments. These transactions aren’t quite as simple as we have a single payment going to two different items in floor plan principal and costs. If we look at just the second transaction we throw the total payment into 2003. We’ll write our check (or process an ach) to the floor plan company against this account for this amount. The rest of the post is simply showing the breakdown. For this curtailment, we paid $600 to principal and $200.14 in interest and fees.

Our third transaction to pay off the floor plan cleared out the remaining principal in 2110, and also paid off any interest and fees that had accrued at that time.

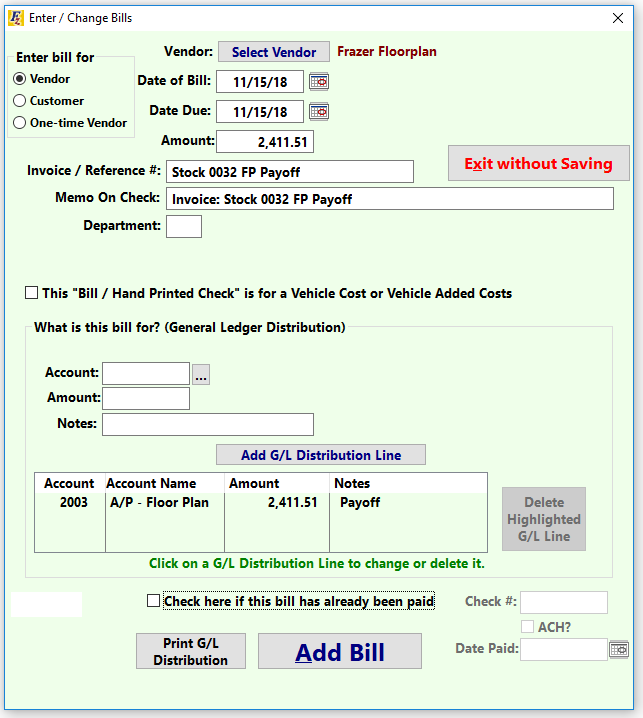

As mentioned previously, the last step to any curtailment payment is to write the check to the floor plan company. This can be done from “Accounting > A - Enter Bills and Hand Printed Checks”.