|

<< Click to Display Table of Contents >> Used Car Dealer Guide |

|

|

<< Click to Display Table of Contents >> Used Car Dealer Guide |

|

Most dealers that sign-up for Frazer have previous dealership experience. From former employees branching out into their own business to former automotive techs selling a few cars from a small garage, Frazer dealers come from many backgrounds. For those with previous experience, the following article may not be terribly useful. But for brand new customer service representatives for Frazer and/or brand new dealers just starting out, the following guide will help you understand the processes and general life cycle of the average independent used car dealer.

Table of Contents:

1.Where do Dealers Obtain Their Inventory?

2.How do Dealers Price Their Inventory?

3.How do Dealers Determine Down Payment?

4.How do Dealers Market to Customers?

5.Sending Vehicles to Auction.

Each employee at Frazer Computing knows who it is that we serve: the Independent Used Car Dealer. However, not many of us have had experience working in the Automotive Retail Industry. The purpose of this guide is to help the Frazer employee with limited to no dealership experience understand the steps a dealership must take in order to get a customer through the door.

Where do Dealers Obtain Their Inventory?

In this first section we are going to discuss how dealers obtain their inventory. Purchasing inventory is a critical aspect of each and every one of our dealer’s businesses and having a better understanding of how this process works can benefit each one of us, as well as our customers.

The most common way for a used car dealership to acquire their inventory is through dealer auctions. As the name indicates not just anyone can attend these auctions, in fact to gain access one would first need to obtain a business license as an auto dealer or wholesaler. Once the license is obtained the dealer or wholesaler must then apply with the auction company to attend in order to attend an auction. Furthermore, individual states may have additional requirements that the dealer or wholesaler must meet.

There are several different types of auctions available to automotive dealerships. These include live closed auctions, live open auctions, and online auctions. Let's take a moment to discuss each of these as they pertain to our dealer's.

Live open auctions are probably the most common source of our dealer's inventory. These types of auctions are open to any licensed dealer or wholesaler that meet the specific state regulations. The automobiles sold at these auctions come from dealers, rental agencies, fleet owners, off-lease vehicles owned by financial institutions, and manufacturers' demos and promotional vehicles.

Live closed auctions will not apply to the majority of our dealers, due to the fact that they are not New Car Dealerships. It may be worth mentioning that live closed auctions are normally run by a specific car manufacturer for their brand's franchise dealers. For those of us who have little to no dealership experience a franchise dealer is an auto-seller that sells new and used cars for auto manufacturers such as Ford, Chrysler, and General Motors. The vehicles sold at these auctions are called “program” cars and are usually late-model vehicles that were returned from a lease or were bought back by an affiliated lienholder for any number of reasons including repossessions.

The last type of auction that we will mention are online auctions. These auctions are similar to both open and closed auctions in regards to who is permitted to participate and the types of vehicles that are sold. The only difference is that dealers and wholesalers partake in these auctions online. Listed below are some well-known Auction Sites we would recommend visiting:

1.Ally Auction

2.Manheim Auction

3.Adesa Auction

Another popular source of inventory for used car dealerships are trade-ins. Many buyers prefer to trade in their current vehicle when purchasing a vehicle. These trade-ins become part of the dealer's inventory and afterward and are sold to other prospective customers.

Auctions and trade-ins aren't the only sources that a dealership will use to obtain their inventory. In fact there are several other options available, and while these options are not as common as the methods previously mentioned they are worth mentioning.

Some dealers may work with a wholesaler (also known as a buyer) who will locate vehicles for them. A wholesale car dealer is a car dealer that may purchase vehicles from car dealer auctions and other car dealers but can only sell to other car dealers, not public customers. Wholesale car dealers are basically re-marketers of vehicles between dealers and generally turn a small profit on each transaction. Vehicles they normally deal with are new car dealer trade-ins, off-lease vehicles, and used car dealers' aged inventory. The wholesale car dealer will also act as a broker between two dealers and never touch the vehicle as far as reconditioning goes.

Dealerships also have the option to purchase used vehicles from other businesses or individuals. For example a used car dealer may contact a business such as Enterprise or Avis and purchase some of their used inventory for the dealership’s lot. On the other hand, it’s possible that an individual who is looking to sell their vehicle will walk into a dealership and do so without making a purchase.

In conclusion we see that there are a variety of ways that a used car dealer can obtain inventory. Now that we've covered each of these methods we can move onto the next section and discuss how dealers price their inventory.

How do Dealers Price Their Inventory?

In this section we will discuss how dealers price their inventory. However, before we begin explaining the process by which dealers price their vehicles, we should first discuss how a dealer will determine what they're going to pay for a particular vehicle.

Whether purchasing or selling a vehicle, a dealer will want to use some type of guide in order to determine the value of that vehicle. Most, if not all, dealers will use an independent source to decide the vehicle's wholesale and retail values. The independent source's primary purpose is to provide used vehicle valuation products and services for financial institutions, credit unions, government agencies, insurance companies, re-marketers, dealers, auctions, manufacturers, and rental agencies. Some of the more popular independent sources that dealers use are (article on Vehicle Valuations available from Frazer):

1.Kelley Blue Book

2.J.D. Power (Formerly NADA)

3.Black Book

The values established by these independent agencies are extremely important to dealerships. These agencies receive real-world data and analyze both new and used car transaction information and use that to put together their pricing data. The following sources are used by vehicle valuation vendors:

1.Wholesale Auctions

Open exclusively to the trade, representatives from dealerships and wholesalers bring vehicles to the auction to trade or sell and may purchase other vehicles they think will sell at their store. Auctions receive their vehicles from dealers, rental agencies, fleet owners, off-lease vehicles owned by financial institutions and manufacturers' demos and promotional vehicles. Agency representatives audit these auctions on a regular basis to gather a better understanding of what the highest possible "actual cash value" (ACV) of a given used vehicle will bring at auction.

2.Independent Dealers

These are the dealerships you see every day that are selling used vehicles only. These dealers sell used vehicles to auctions, consumers, and wholesalers.

3.Franchised Dealers

These are specifically branded new car dealerships authorized by the respective manufacturer such as Honda, Ford, etc. These dealers sell used vehicles to both auctions and consumers.

4.Rental & Fleet

Rental fleets usually send their cars to auction after one year of service, but have extended that usage in recent years.

5.Original Equipment Manufacturers (O.E.M.s)

The manufacturers (such as Honda, Ford, etc.), bring used vehicles to auction after they have utilized them as employee cars, promotions, or other company distributions.

6.Financial Institution Lessors

When you lease a car, the bank owns it and you rent the use of the vehicle. After the term of the lease is complete, these pre-owned vehicles are either sold back to the lessee or directly to a dealer at auction. Financial institutions also trade and sell repossessed cars and trucks.

7.Consumer Private Party Transactions

Each of the companies named above track consumer sale prices each year.

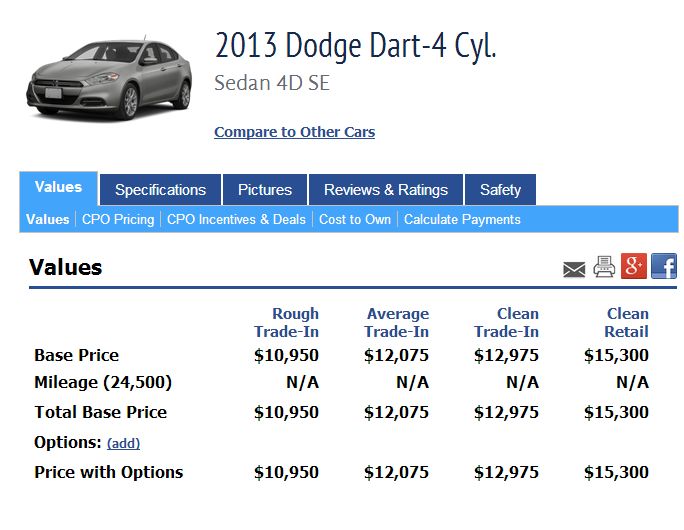

Now that we understand how these companies determine the value of each vehicle let's take a look at two extremely important terms: trade-in value and retail value. The image below shows how a company like Kelley Blue Book differentiates between the two values and even takes it a step further and breaks the trade-in values down by vehicle condition.

Let’s take this opportunity to expand on the different categories used in these guides.

The wholesale value of a vehicle is the value that a dealer would pay to purchase it from a car manufacturer. In the case of trade-in vehicles, the wholesale price might also be the price a dealer would pay to purchase the vehicle from a dealer auction. At any rate, wholesale value is a measure of dealer cost. Keep in mind that the dealer must absorb the costs of making the vehicle ready for sale, so trade-in values are almost always lower than retail or private party values.

As the picture above depicts there are several factors that can determine the trade-in value of a vehicle:

1.The condition of the vehicle. Vehicles at dealer auctions are priced based on whether their condition is above average (clean), average, or below average.

2.The age and mileage of the vehicle. Vehicles depreciate in value with increased age and mileage. This means that the older the vehicle is or the more mileage it has, the less the vehicle is worth even if it is in perfect condition.

3.The listed book price (from the independent source) for the vehicle. The independent sources offer estimations of value for vehicles based on their make and model, condition, and age. Wholesale prices are often close to these estimated prices.

It's important to understand the factors that can influence the wholesale price of the vehicle because it is often the price that the dealer offers as a trade-in. Dealer prices may be slightly lower than the wholesale value of the vehicle because of several outside factors. A dealer will need to consider the potential expense of added costs and other reconditioning that they may need to cover in order to make a vehicle fit for sale to the public. Often, this consideration may lead a dealer to offer a trade value that is less than a valuation vendor's wholesale value.

The suggested retail value of a vehicle represents the amount an auto dealer might ask for a specific vehicle. This retail value is not a trade-in or private party value and assumes that the vehicle has been fully reconditioned and has a clean title history. The suggested retail value also allows for advertising, sales commissions, insurance and other costs of doing business as a dealer. This amount is a starting point for negotiation; therefore, the actual sale price will vary. A vehicle's popularity, condition, warranty, color and local market conditions are factors involved in determining a final price.

While using independent source guides is the most common practice for pricing inventory, dealers may consider other factors too. Many factors can determine whether a vehicle sells for more or less than the valuation guide's suggestions. Factors such as whether the vehicle is floor-planned, what the dealer has sold a similar vehicle for in the past, or the average markup they like to keep can have an effect on the pricing of a vehicle. A dealer will take all these pieces and put them together when they decide how they're going to price their inventory.

There are also dealers who may completely disregard the independent sources. For example, a dealer may choose to use the average auction prices when pricing their inventory or perhaps they prefer to use internet sites like Cars.com to see what similar vehicles sell for in their local market. Regardless of the process the dealer chooses, we should understand that pricing out inventory is an essential part of the automotive retail industry.

How do Dealers Determine Down Payment?

After a dealer has settled on the retail price of a vehicle, they will decide whether they will require a down payment for the purchase of that particular vehicle. A down payment is a payment used in the context of the purchase of expensive items such as a car or a house, whereby the payment is the initial upfront portion of the total amount due. The down payment is usually given in the form of cash or check at the time of finalizing the transaction. A loan may cover the rest of the amount to finance.

There really is no set guideline for determining how much down payment a dealer is going to require on a certain vehicle. A variety of factors may come into play when setting a down payment amount. For instance, a dealer may require a down payment due to the costs associated with a particular vehicle. On the other hand a dealer may have a high rate of repossessions and therefore may require that each vehicle they sell have a minimum down payment amount.

Additionally, whether a buyer is financing the purchase of a vehicle with an outside finance company (as opposed to a buy-here pay-here deal) can have an effect on the down payment. In this scenario the down payment will depend upon the outside finance company's maximum loan to value. The loan to value is a lending risk assessment ratio that financial institutions and other lenders examine before approving large loans. For all vehicle sales, outside finance companies are only willing to lend a certain amount of money to the person(s) buying the vehicle. The amount they lend is determined by several factors, including the value of the vehicle being sold.

For the purposes of this guide it may be beneficial to give an example of how this can effect the down payment:

Let's assume that for a particular sale a vehicle has a retail value of $10,000. However, due to certain risks, the finance company is only willing to lend 80% of the vehicle's value ($8,000.00). It's probably safe to assume that the dealer is not going to reduce the price of their vehicle to $8,000 just because that is the maximum amount the finance company is willing to lend. Instead, the dealer is most likely going to require a down payment for the purchase of that vehicle. The down payment will allow the dealer to receive the amount they want for the vehicle while reducing the risk for the bank, which increases the likelihood of the bank purchasing the contract.

How do Dealers Market to Customers?

We're now going to discuss the different marketing strategies dealers use to get customers through the door. While we won't be covering every single marketing strategy a dealer may use, we will touch on some of the most popular ones:

1.Zero Percent Financing

Zero percent financing means financing that bears no interest. The creditor loans you the money, and you only need to pay the money back within a specific time frame. No additional monthly fees will be charged, and you won't pay back any more than the amount you borrowed. This practice is most often associated with the franchise dealers, using a lienholder often associated with their OEM. Car dealers may also offer zero percent financing on vehicles that are not selling well or during periods of economic hardship when people are less inclined to make large purchases.

2.No Credit Checks

No credit check auto loans usually means a much easier approval process, however, it does not mean automatic approval. The loans associated with this type of marketing are generally income-based. As long as you have a regular source of verifiable income, you can typically get approved for financing. Many times, a significant cash down payment is required, along with a higher interest rate versus a more conventional loan. Dealers selling with these types of loans may install collection technology to ensure prompt payments. Devices such as GPS/ Starter Interrupts may be installed and can be activated if a payment is missed. In addition, vehicles can be priced higher than the listed retail value with little or no negotiating room. This is all due to the high risk and repossession rates associated with these types of loans.

3.No Money Down

No money down means that the dealer is not going to require any type of down payment. This basically means that a buyer can walk into the dealership without a single dollar and walk out with a new vehicle. Many car dealers have no money down programs for buyers with good credit. This adage also holds true for many banks and credit unions as well. In general, you'll need a FICO score (credit score) of 700 or more to qualify. Additionally, you'll need to be paying a good price for the vehicle in question – at or below the book value or the equivalent. If you are paying a price that is too high for the vehicle, you may get no money down financing at the dealership that is charging you that price, but you won't get it from any other financial institution. If you have a trade-in, it's even easier to get a no money down loan from the dealer, since the positive equity of the trade will count as money brought into the deal.

4.FREE, FREE, FREE

Dealers will often use free giveaways to get customers through the door. Some services that a dealer might give away with the purchase of a vehicle includes: oil changes, reconditioning (auto detailing services), full tank of gas, and even limited warranties.

5.Save You $$$$

Who doesn't want to save money?!? A popular tactic among dealers is to advertise that they will lower your payment or payoff your trade-in. Both of these strategies are extremely effective as they address the most common concerns of the vehicle buyer: current payment and future payment.

As previously discussed, a car dealer auction is a specialized form of auction. Millions of vehicles are sold at such dealer auto auctions every year. These auctions are restricted for the general public and only licensed dealers can participate. Prices of vehicles sold at dealer auctions tend to be lower than those advertised on any dealer's lot. Sellers forgo a potentially higher sticker price to take their inventory to a dealer auction where it will be auctioned off for thousands less than retail.

Some may wonder why a dealer would send a car to auction if they're going to potentially lose thousands of dollars doing so. What must be understood is that maintaining aging inventory costs dealers both money and reputation. Most vehicles sold at auction are off-lease returns, replaced rental fleets, company cars, repossessed vehicles, and trade-ins.

•Off-lease: vehicles returned to the financial institution at the end of a lease. Closed auctions are usually the only venue for such financial institutions to dispose of a large volume of end-of-lease returns.

•Off-rental: rental companies normally replace their fleets once a year, releasing a flood of late-model cars to the secondary market. Like the big financial institutions that underwrite car leases, rental companies also rely on auctions to sell off their used inventory.

•Company/Fleet cars: companies of varying sizes own or lease cars, trucks, or vans that they typically keep for two or more years.

•Repossessed: vehicles can be voluntarily or involuntarily repossessed by financial institutions for delinquency or another reason for recall. Auto auctions are again the bank's only option for deliverance. Repossessed vehicles can feasibly sell for less because the financial institution disposing of them only seeks to offset its losses (also restricted by federal regulations).

•Trade-in: dealer inventory that is aging or does not meet their profile (excessive mileage, unmanageable repairs..etc).

Among these types of vehicles there are a number of quality cars ready to market. Late models with remaining factory warranty are not uncommon. The law requires listing dealers to disclose bigger mechanical problems, which may void the manufacturer’s warranty and classify the vehicle as junk, salvage, lemon/consumer buy-back, etc. There are special auctions for these types of vehicles (salvage, rebuilt or junk vehicles), sold mostly by insurance companies.

Pricing

Regardless of their source, vehicles are sent to auction with the main purpose of being sold quickly and hassle-free. Contrary to popular belief, cars seldom sell for unreasonably low prices at the dealer auctions. This may happen if there are not enough interested bidders or if the vehicle is exceptionally unattractive, though this instance is quite rare. Many sellers put reserve prices on their stock specifically to prevent this from happening. The reserve price is not disclosed publicly and a “winning” auction bid is only considered a sale if the reserve price is met. Sellers have the option to re-list vehicles that did not sell at a particular auction.

The Process

Prior to sending the vehicle the dealer must contact their auction company with the vehicle information (Year, Make, Model, VIN, Mileage and Condition). After providing the vehicle information, the auction house assigns the vehicle a run number, which determines the lane and the order in which the car will appear. The lane a vehicle is assigned to, is usually determined by the make and the person/business selling the vehicle. For instance domestic cars from dealers may be on lane A while imports are on lane B and domestic fleet cars are on lane C. There is no significance to the order in which the car appears. Immediately following the submission of a vehicle to auction the dealer must send all necessary title work.

The costs associated with selling a vehicle at auction include auction fees and transportation costs (if shipping vehicles). The auction fee may be a tiered percentage based on the amount the vehicle sells for. For instance a vehicle that sells for $5,000 may have an auction fee of 5%, while a vehicle that sells for $10,000 may have an auction fee of 5.5%.

Conclusion

Hopefully this guide is a good jumping off point for dealers that are new to the business. For any other questions feel free to reach out to one of Frazer's friendly Customer Service Reps OR your local IADA. For a list of helpful links by state, click here!