|

<< Click to Display Table of Contents >> R-4 Accounting Reports |

|

|

<< Click to Display Table of Contents >> R-4 Accounting Reports |

|

Because of the complexity of our accounting reports, our accounting reports section will mostly focus on R-4-4, Year End Reports.

Other helpful resources:

What are the Year End Reports?

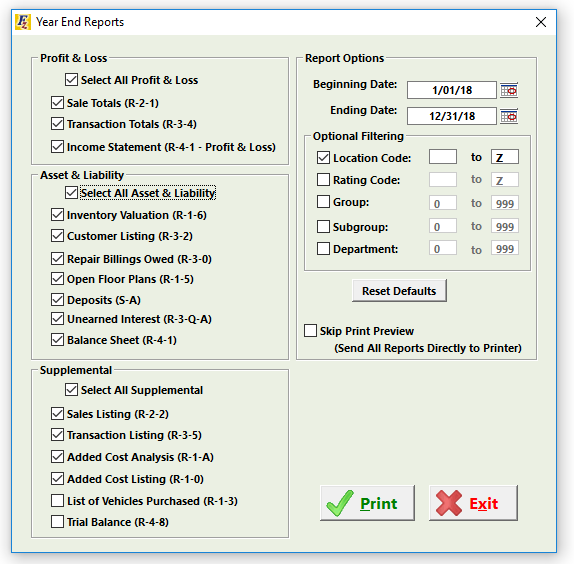

The Year End Reports in Frazer are a series (list) of reports that our Frazer Accounting team have compiled to help you get the numbers you need to close out the year and, more importantly, file your taxes. In some cases this raw data can be taken, just as you have entered it, by your accountant and used to file your taxes. Other reports may not be as useful if you’re not using Frazer’s Accounting to its fullest extent. To access “Year End Reports” you can navigate to the “Accounting” drop-down menu and then select option “W - Year End Reports” or you can navigate to the “Reports” drop-down menu and then select “4 – Accounting > 4 – Year End Reports”.

By default the dates of the report will always reflect last year’s calendar year unless you have set a different fiscal year using the system option under “Miscellaneous > 1 - System Options, 8 - Accounting”.

You may also choose to separate your data using the box to the right. Your options include “Location Code”, “Customer Ratings”, “Customer Groups”, “Customer Sub-groups”, and finally by accounting “Department”.

Note: You also have the option to skip a “Print Preview” when you click print. Frazer does not recommend skipping the print preview without first checking to see how many pages the total of these reports will generate. Depending on the size of your dealership, and the checkbox selection, the total pages can reach well over 100 in certain cases.

The Profit & Loss Reports:

The Profit & Loss reports will give you a snapshot of the profitability of your dealership.

Sales Totals (R-2-1):

Gives you a snapshot of your profitability in regards to your sales totals. (This report does not take into account any money received / not received.)

Transaction Totals (R-3-4):

Gives you a snapshot of the total payments received for all of your sales. (This report will only include payments actually received.)

Income Statement (R-4-1):

The scorecard for your business. This report takes into account all income and expenses including those that are not related to sales. (Expense examples include: Rent, Payroll, etc.) Note: When run through the “Year End Reports” option, the “Month-to-Date” section is actually printing last year’s numbers as well.

Can these reports be used even if I haven’t used the Frazer Accounting Setup Tool?

Yes. Assuming you have entered all of your expenses (including those not related to car sales), then your Income Statement should be accurate for any particular period of time. For Sales Totals and Transaction Totals, as long as sales information (including any costs related to sub-prime financing) and payments received are logged accurately then both of these reports should be accurate, regardless of whether the dealership has formally set up their accounting within the Frazer program.

The Asset & Liability Reports:

The Asset & Liability reports will give you a snapshot of the total value of your inventory and accounts receivables balances for the end of the year.

Inventory Valuation (R-1-6-1):

The Inventory Valuation reports provides a snapshot of the total costs you have accrued on a per-vehicle basis, including added costs and Floor Plan expenses. The report includes totals and averages at the end.

Customer Listing (R-3-2):

The Customer Listing report will provide your customers’ current balances as of the last day of the year as well as any extra balances including Pickup Notes, Repairs, and Fees. It also breaks out the “Earned Interest” as of that date.

Repair Billings Owed (R-3-0):

The Repair Billings report will show you customers that owed you for repair balances as of the last day of the year. The report will show you both the total billed as well as the balance that was current as of the specified date.

Open Floor Plans (R-1-5):

The Open Floor Plans report will show your open floor plans for the last day of the year. The report includes the amount floored as well as the principal remaining.

Deposits (S-A):

The Deposits report will show you any open deposits as of the last day of the year.

Unearned Interest (R-3-Q-A):

This report totals your Unearned Interest as of the last day of the year. Note: If you use “simple interest” exclusively then you do not need this report as it only pertains to pre-computed interest. In other words, there is no such thing as “unearned” interest in regards to simple interest.

Balance Sheet (R-4-1):

The Balance Sheet displays your balances for your Asset, Liability, and Equity accounts as of the last day of the year.

Can these reports be used even if I haven’t used the Frazer Accounting Setup Tool?

Most of them can be. Your Balance Sheet will not be accurate if you have not used the Setup Tool. However, the other reports may be accurate as long as inventory values, sales values, and customer payments have been entered correctly.

The Supplemental Reports:

The Supplemental Reports for the most part are a more detailed look at information presented in one of the previous reports.

Sales Listing (R-2-2):

The Sales Listing shows a profitability recap for individual sales. This would supplement your “Sales Totals” report from above.

Transaction Listing (R-3-5):

The Transaction Listing report shows all individual payments received for the last year. This would supplement your “Transaction Totals” report from above.

Added Cost Analysis (R-1-A):

This report analyzes added costs both before a vehicle is sold, as well as after a vehicle is sold. This report would supplement your “Inventory Valuation” and “Repair Billings Owed” reports above.

Added Cost Listing (R-1-0):

This report lists all of your added costs for the past year. This report would supplement your “Inventory Valuation” report above.

List of Vehicles Purchased (R-1-3):

This report will include a listing of every vehicle acquired (including via repossession or trade-in) as well as their original cost. This report supplements your “Inventory Valuation” report above.

Trial Balance (R-4-8):

The Trial Balance Report breaks down all of your “Balance Sheet” accounts and shows your totals as far as debits and credits to each individual account. Additionally it provides a balance for the beginning of the year and a balance for the end of the year. This is a supplement to your Financial Statements including the Balance Sheet and the Income Statement.

Can these reports be used even if I haven’t used the Frazer Accounting Setup Tool?

For the most part, yes. However, if you have not set balances using our “Setup Tool” then your Trial Balance Report may not accurately reflect “real life” balance amounts. The debits and credits may be correct assuming good data was entered into Frazer throughout the year.