|

<< Click to Display Table of Contents >> Pause Payments |

|

|

<< Click to Display Table of Contents >> Pause Payments |

|

In order to help dealers better serve their customers, Frazer has setup a way for dealers to quickly and easily pause a customer’s account for a period of time.

What is this? You may be asking how this feature works in the background. Basically, the “pause payment” button acts as if you pressed the refinance button twice. The first refinance will set the customer’s new due date as well as change the customer’s APR to 0%. On the resume date, (or second refinance) the APR will automatically change back to the original APR prior to pressing "Pause".

The only difference between the "pause payments" feature and a "double refinance" is that the customer's original amortization schedule stays in tact. (More on that here!)

To get started open up the customer in “Customer Activity”.

From there, look for the “Pause Payments” button.

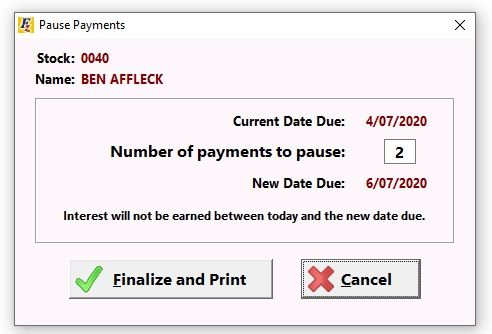

With the window open, select the number of payments you’d like to pause.

Frazer will display the new due date.

When you’re done, click “Finalize and Print”.

Frazer will print a Contract Modification Agreement.

You may notice that this document looks very similar to the Contract Modification Agreement that prints with a normal refinance. The main difference is that this new document will outline the length of time that the customer’s account will not be accruing interest.

Removing (or unwinding) a “pause” is the same as removing or reworking a customer refinance. Open the customer in Customer Activity and look for the “Payments Paused” button.

This will open up the “Pause Details” window.

From this window you can see the details of the transaction, reprint the modification, print a summary, or delete the "pause" transaction.

If you find that you need to prolong the “pause” you can enter the “pause payments” screen again using the button and prolong the schedule even further.

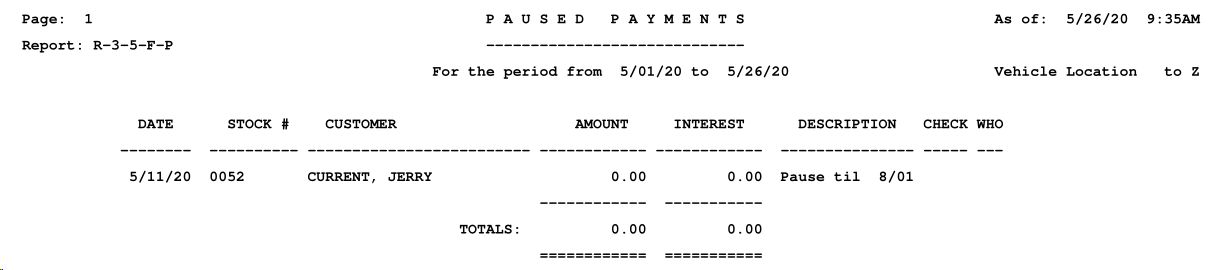

Reporting: R-3-5-F-P

For a listing of customers previously paused, navigate to the Reports > 3 - Customer Reporting > 5 Transaction Listings and select "report type" F - Contract Modifications (Refinancing). Enter your beginning and ending dates and then check the box to "Only Include Paused Payments".

The report will show a listing of all of the customers for which you've "Paused Payments".

How will this affect my customer's balance due?

Basically when using the pause button, Frazer is just picking up the old amortization schedule and putting it back down on the next due date. As a result, you may notice the customer's "balance due" behaving in strange ways. Follow along with the scenarios below to see how using the pause button will effect your customer's balance due.

Important note: The change in balance due is really more of an amortization schedule quirk than a full re-calculation of the payment schedule. Although you may notice a "balance due" that doesn't make total sense to the naked eye it's important to point out that you WILL STILL COLLECT THE SAME NUMBER OF PAYMENTS OVER THE LIFE OF THE LOAN.

The thing to understand is that no matter however many number of payments the customer is pushed out. When that amount of time passes, the customer will be in the same state they were the day you hit "pause".

I am pausing my customer for one payment:

•My customer is currently ahead.

•My customer is currently behind.

I am pausing my customer for two payments.

|

The customer is showing as nothing due at this present moment in time. |

|

Dealer pauses the customer for 1 month. |

|

Customer shows ahead by 1 month as their due date has been pushed forward by 1 month. |

Why? |

Since the customer is current, pushing them out a month makes it so that they no longer owe a payment as of June 1, therefore they're paid ahead on their contract. On June 1st, (the normally scheduled due date pre-pause) the account will become "current" again and no longer show as paid ahead. The reason the program works this way is because when we pause the payments we're picking up the amortization schedule and placing it into the future. |

|

The customer's previously scheduled due date passes and the system "catches up" to the amortization schedule. |

|

The customer is showing as ahead by a half payment. |

|

Dealer pauses the customer for 1 month. |

|

Customer shows ahead by a payment and a half as their due date has been pushed forward by 1 month. |

Why? |

Since the customer was paid ahead by a half payment when we chose to pause, pushing them out a month makes it so that they are now paid ahead by an additional payment. The customer will now show as paid ahead on their contract by a full payment and a half. On June 1st, (the normally scheduled due date pre-pause) the account will drop that extra payment and show as only being ahead that half payment again. The reason the program works this way is because when we pause the payments we're picking up the amortization schedule and placing it into the future. |

|

The customer's previously scheduled due date passes and the system "catches up" to the amortization schedule. In this case the customer will show as a half payment ahead. (Same as before the pause.) |

|

The customer is showing as behind by a payment. |

|

Dealer pauses the customer for 1 month. |

|

Customer shows as current since their due date has been pushed forward by 1 month. |

Why? |

Since the customer was behind by a payment when we chose to pause, the customer's due date was pushed forward therefore making them current. The customer will now show as paid. On June 1st, (the normally scheduled due date pre-pause) the account will drop the current state and show as behind again. The reason the program works this way is because when we pause the payments we're picking up the amortization schedule and placing it into the future. |

|

The customer's previously scheduled due date passes and the system "catches up" to the amortization schedule. In this case the customer will show as behind. (Same as before the pause.) |

Balance due scenarios when pausing 2 payments:

|

The customer is showing as nothing due at this present moment in time. |

|

Dealer pauses the customer for 2 months. |

|

Customer shows ahead by 2 months as their due date has been pushed forward by 2 months. |

Why? |

Since the customer is current, pushing them out 2 months makes it so that they no longer owe a payment until August 1st, therefore they're paid ahead on their contract. On June 1st, (the normally scheduled due date pre-pause) the account will show them ahead by a payment. On July 1st the balance due will become current again. The reason the program works this way is because when we pause the payments we're picking up the amortization schedule and placing it into the future. |

|

The customer's previously scheduled due date passes and the system "catches up" to the amortization schedule. In this case the customer shows as current. (Same as before we paused the payments.) |

|

The customer is showing as ahead by a payment. |

|

Dealer pauses the customer for 2 months. |

|

Customer shows ahead by 3 payments as their due date has been pushed forward by 2 months. |

Why? |

Since the customer was paid ahead by a payment when we chose to pause, pushing them out 2 months makes it so that they are now paid ahead by 3 payments. On June 1st, (the normally scheduled due date pre-pause) the account will drop one of the extra payments and show as only being ahead 2 payments. On July 1st, the account will again show as being ahead by only 1 payment. The reason the program works this way is because when we pause the payments we're picking up the amortization schedule and placing it into the future. |

|

The customer's previously scheduled due date passes and the system "catches up" to the amortization schedule. In this case the customer will show as 1 payment ahead. (Same as before the pause.) |

This scenario is perhaps the most confusing. When pushing a due date out more than 1 month, there are scenarios where a customer can go from being behind to "showing ahead". Keep reading for the full breakdown.

|

The customer is showing as behind by a payment. |

|

Dealer pauses the customer for 2 months. |

|

Customer shows as ahead since their due date has been pushed forward by 2 months. |

Why? |

Since the customer was behind by a payment when we chose to pause, the customer's due date was pushed forward therefore making them ahead on their contract. On June 1st, (the normally scheduled due date pre-pause) the account will show as current. On July 1st, the account will again show as being behind. The reason the program works this way is because when we pause the payments we're picking up the amortization schedule and placing it into the future. |

|

The customer's previously scheduled due dates pass and the system "catches up" to the amortization schedule. In this case the customer will show as behind. (Same as before the pause.) |