|

<< Click to Display Table of Contents >> Texas |

|

|

<< Click to Display Table of Contents >> Texas |

|

Frazer tries to provide programming to tailor the functioning of the system to the laws of the state that you are operating in. These may include specific tax rates for various municipalities, state specific forms or interest and late fees limits Because of this, the functioning of the system may be different from one state to the next.

Texas Comptroller of Public Accounts

Texas Department of Motor Vehicles

Texas Office of Consumer Credit Commissioner (OCCC)

3. Effective APR - Regulation Z

4. Texas Comptroller Audit information regarding deferred sales taxes on down payments.

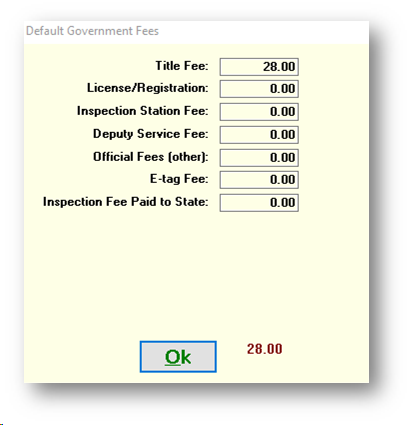

Frazer Provides a System Option to set your Default Government Fees. Check with your local agency to verify the correct amount for your area.

Inventory Tax is a property tax imposed on the dealership that is charged on the price of each vehicle sold. The tax rate is assigned to the dealership by the dealership's county of residence.

The inventory tax is remitted monthly to the county tax office by the 10th of the month with prepayment of the taxes. The dealer has to pay the tax whether or not the customer is charged.

A new dealer starts without a rate for the first year and does not owe the tax, however, the dealer is still required to file the Inventory Tax Statement with the county.

To enter or update the current Inventory Tax rate, go to Miscellaneous >> 1 - System Options >> 3 - Taxes. Enter the decimal equivalent of the % given by the county. Frazer will remove the first two zeroes after the decimal point. There is also a default option to bill the customer for the tax in this options screen or this option can be selected on a per deal basis.

Frazer will automatically record inventory tax when it is required for the sale, using one of four possible designations: MV, FL, DL, or SS. Inventory Tax is collected only for the MV designation, whether or not the customer was charged.

MV |

|

A regular motor vehicle inventory sale. Inventory tax is collected. |

FL |

|

Five or more motor vehicles sold to the same buyer within one calendar year (Fleet Sale). There is no inventory tax. |

DL |

|

A wholesale deal. There is no inventory tax. |

SS |

|

When a vehicle more than once in the same calendar year, there is no inventory tax for the 2nd sale (Subsequent Sale).

|

** Sales to Mexico are still subject to VIT. If the customer's license is listed as a Mexican Passport, the type of sale will be printed as "MV". If the address of the customer is listed as Mexico, the type of sale will be incorrectly printed as "export-MX" instead of "MV". Regardless, as previously stated, the sale is still subject to the VIT. There are no exceptions for exporting vehicles out of the state of Texas.

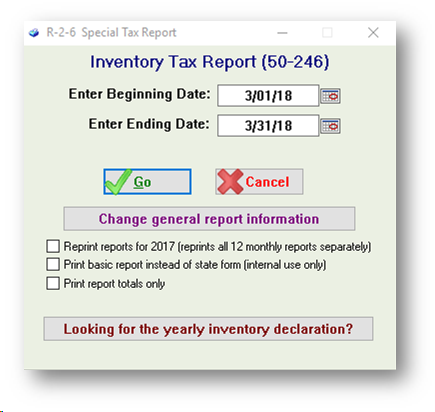

To print the actual Inventory Tax Report, go to Reports >> 2 - Sales Reporting >> 6 - Inventory Tax Report.

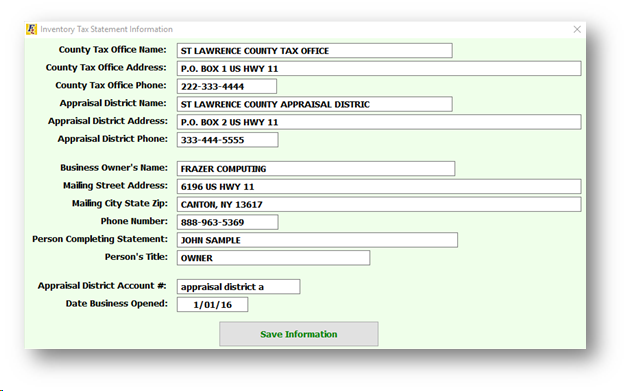

If the report has not been generated previously, a screen will automatically appear where Inventory Tax Statement Information is entered. Fill in the information and Save.

Enter the date range desired. The program will automatically default to the previous month unless changed.

Click on ![]() . There is no print preview for the report - it will simply print to the white paper printer. To see a preview of the data, either check the box to "Print Report Totals Only" or check the box to "Print basic report instead of actual form."

. There is no print preview for the report - it will simply print to the white paper printer. To see a preview of the data, either check the box to "Print Report Totals Only" or check the box to "Print basic report instead of actual form."

For BH-PH sales in which you remit your sales taxes to the state on a deferred basis (once a month based on payments received the previous month) you are not allowed to charge interest on sales taxes. However, when you print your contracts the sales tax is included in the "Amount Financed" section creating a second "effective" APR that must be disclosed in the Federal Regulation Z box. You will then have two APR's associated with these deals - One is the APR that you enter and that is used to calculate financing (but not on the sales tax) and the second is the effective APR based on the sales tax being included in the Federal Disclosure box. It is important that you have the first APR to be able to prove that you did not charge interest on the sales tax.

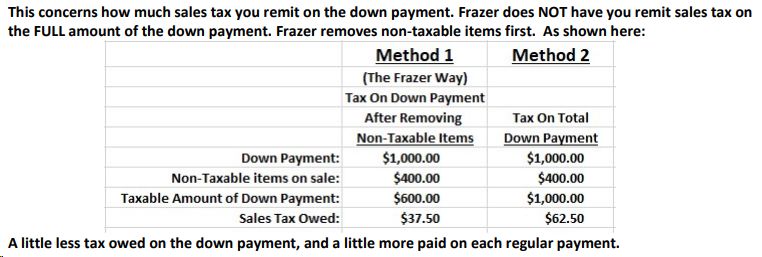

Deferred Sales Taxes on Down Payments Itemization

What’s Going On

Texas Comptroller auditors were starting to challenge Frazer BHPH dealers based on what we presume is a stricter interpretation of an old rule addressing sales tax due on down payments.

The Rule

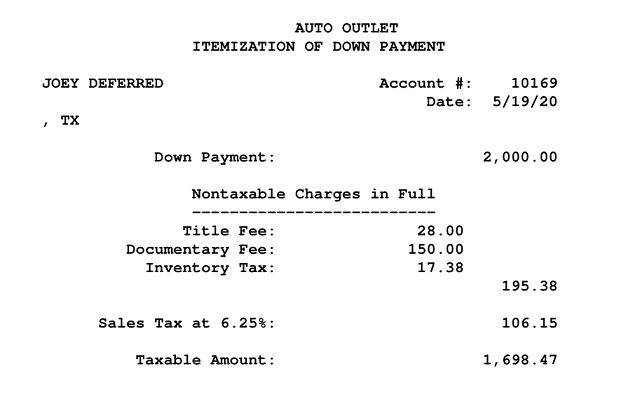

The Rule is 3.74(e)(1). It states: “The total downpayment is subject to motor vehicle tax unless the payment is itemized to indicate nontaxable charges.” Before May 2017 this was embedded in Rule 3.74(c)(1), but is the same rule.

What Frazer Does

Frazer does NOT have you remit sales tax on the FULL amount of the down payment. We remove nontaxable items first. When this was first addressed by an auditor 15 years ago (Frazer started doing business in Texas in 1997) we referred the auditor to the itemization of nontaxable items on the Buyer’s Order and that was accepted as conforming to the rule. This itemization of nontaxable items on the Buyer's Order has continued to be accepted on thousands of audits since.

What Changed

The rule has not changed, and Frazer has not changed. We believe something happened within the Comptroller's office to place a stricter interpretation on this rule.

What You Should Do

Update Frazer. New features have been added to Frazer!

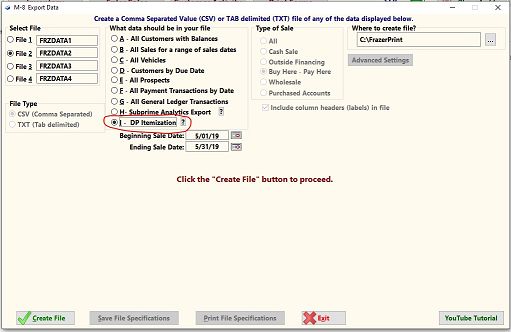

1) A spreadsheet has been added in M-8 Export Data which will allow you to provide the auditor with the down payment itemization indicating nontaxable charges for any range of dates.

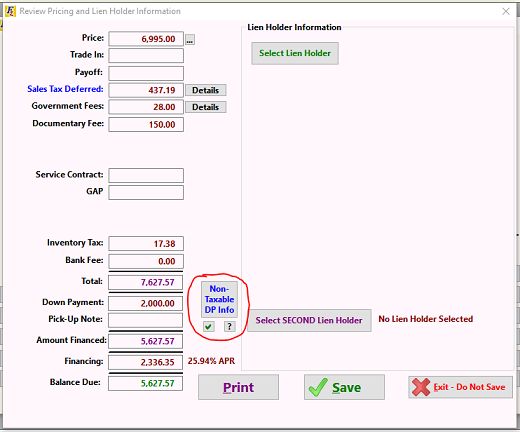

2)A button listing the “itemization of the down payment indicating nontaxable items” for each individual, BHPH customer has been added to Customer Activity – L Review Pricing.

3) Frazer has created a new form that will satisfy the new requirements. It is a requirement that all customers sign this form as part of the deal paperwork.

The new form is: Form number: 71702 Sales Tax Disclosure.

Note that there is a signature line on the form.

The Outcome

Frazer (with help from the Texas IADA) is excited to announce that as of June 2020 the Comptroller has announced that there will be no penalties or back taxes owed on deals that occurred prior to the Sales Tax Disclosure's existence. The new disclosure will be required on all deals going forward. Furthermore, Frazer appreciates the efforts of the Texas IADA for their tireless work on ensuring that Texas Dealers are given a fair market to operate in.