|

<< Click to Display Table of Contents >> 1099s |

|

|

<< Click to Display Table of Contents >> 1099s |

|

This article on 1099s will be broken into 3 parts:

oItems to check before printing 1099s

oPrinting and verifying 1099 paperwork (Or the 1096 form)

How 1099s work:

In Frazer, the numbers that appear on 1099s are derived from any costs entered into Frazer that have been paid using an asset account and are attached to a vendor.

Why are only asset accounts accepted?

Entering a cost paid for via liability (such as Accounts Payable 2000) and then paying down that liability when writing a check could double up costs associated with a vendor. As a result, we decided to eliminate this issue by only counting asset payments on the 1099.

What about instances where I pay a vendor with a credit card?

You will not need to report these amounts on the 1099s you produce, as the credit card companies will be reporting those payments themselves on their 1099-Ks that they will provide to the vendor receiving the payment.

What part does Frazer play in printing 1099s?

Frazer can fill in the pre-printed 1099 forms, which are available from the IRS or any office supply store.

Items to check before printing 1099s:

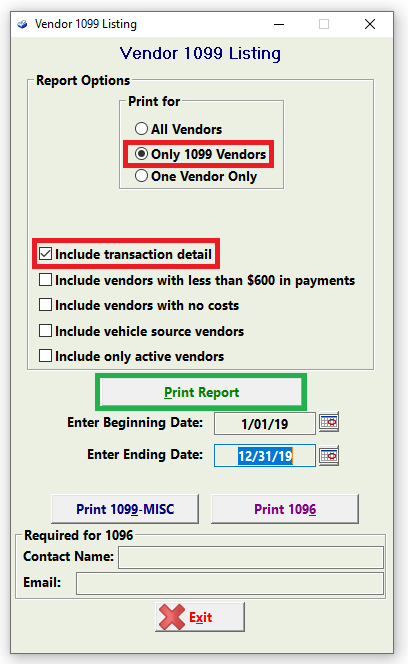

Frazer recommends running a report to verify that all vendors look correct. To run a report that includes all of your vendors navigate to Accounting >> 6 - Vendors >> 3 - 1099s.

You will then be presented with a report options window. From here, let's run a report with ALL of the boxes checked and include all of our vendors just in case a vendor is set up incorrectly.

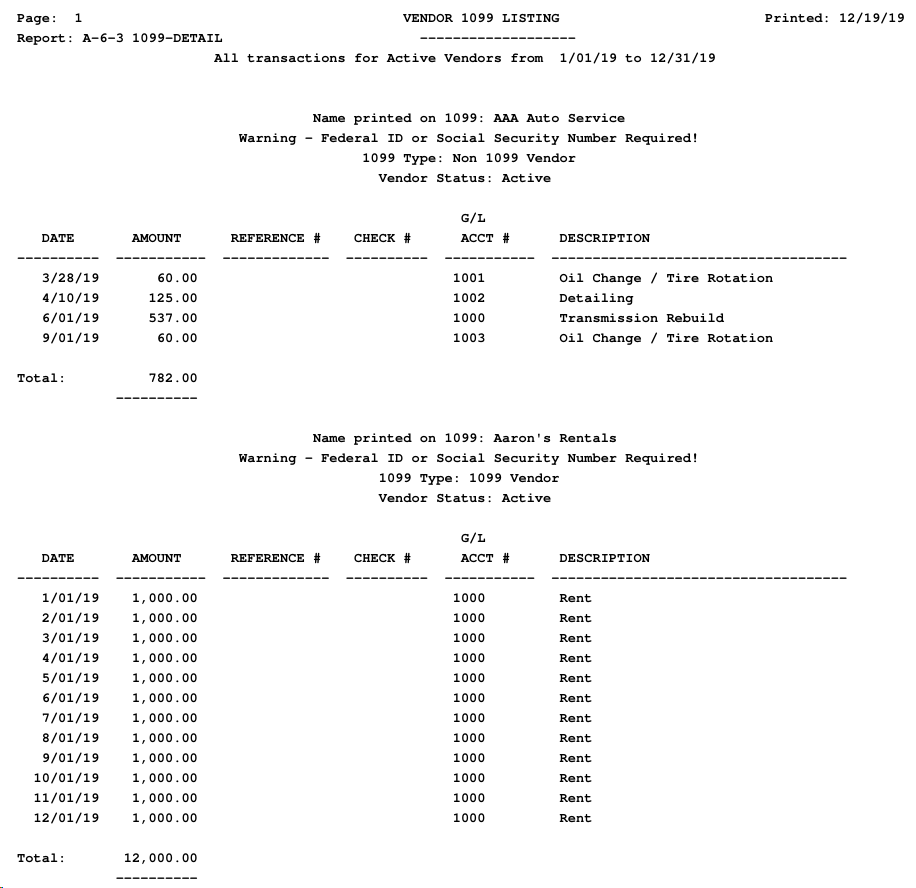

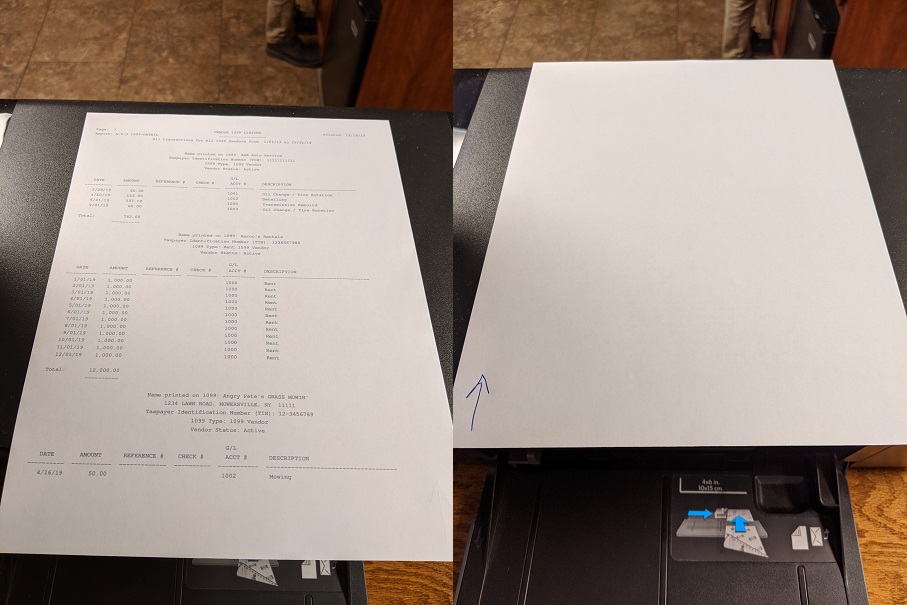

Once we run the report, let's take a look at our vendors:

In reviewing your report you'll want to pay close attention to the vendor listings, as Frazer will note the vendor types and whether they're active. Running this report will give you both the opportunity to verify the amounts paid, as well as the ability to ensure that all of the vendor information is entered correctly.

You can edit the vendor information on the vendor's file.

Once you've made any edits to the vendors (or added any payments missing) re-run the report using the same parameters:

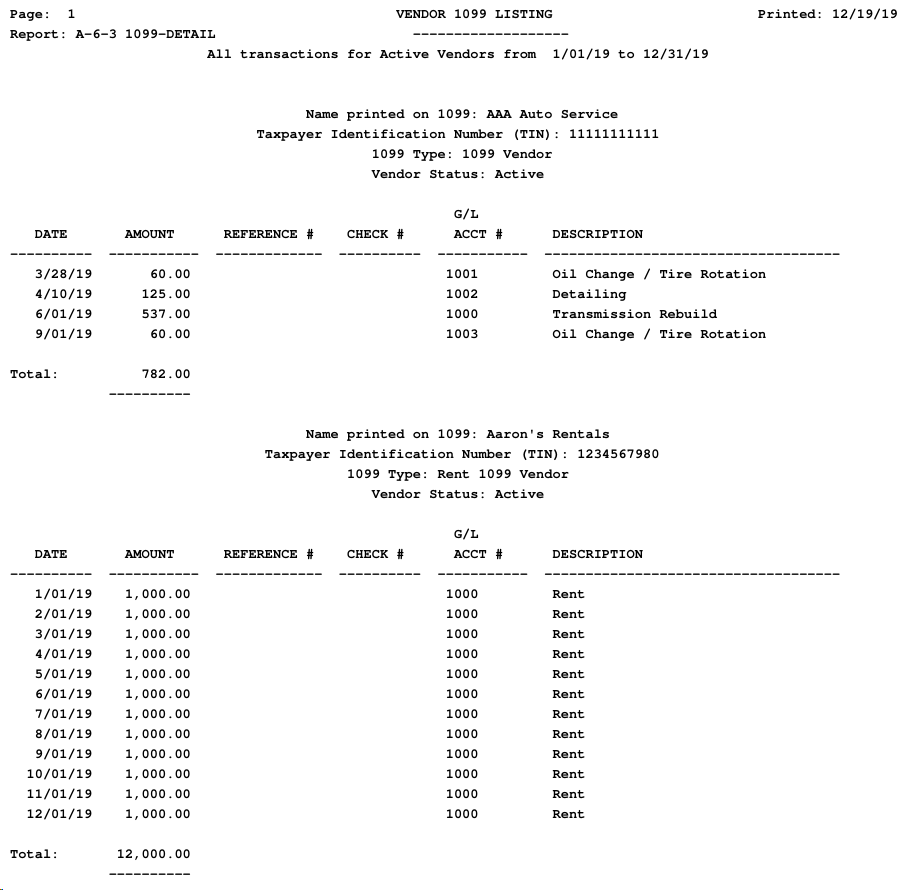

If everything looks good, let's run the report one more time, but this time to verify that our 1099's will be accurate.

When we run the report this time we're only going to run it for our 1099 vendors. You have the option to run the report for vendors with less than $600 in total payments (or no costs). As Frazer points out, you are not required to send 1099s to vendors in which you have paid less than $600 in a calendar year.

If the report looks ready to go, it's time to print on our 1099's!

Printing the 1099:

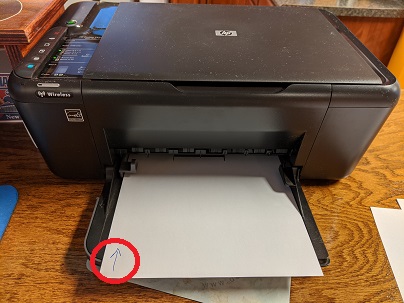

Before printing, you will need to determine the orientation of your printer. Place a blank piece of paper (with an arrow drawn in the left hand corner) into your printer tray.

Next, print a test page. (You could even print a report or single page document from Frazer) Note: Do NOT press "Print 1099-MISC" as that will print all of the 1099s you have queued up based on the number of vendors in the system.

Next, compare the newly printed test page with the orientation of the arrow:

If I compare my printed page to where my arrow ended up, it becomes apparent to me that I need to load my 1099 into my printer face-down and right-side up. Your printer may need to be loaded with a different orientation.

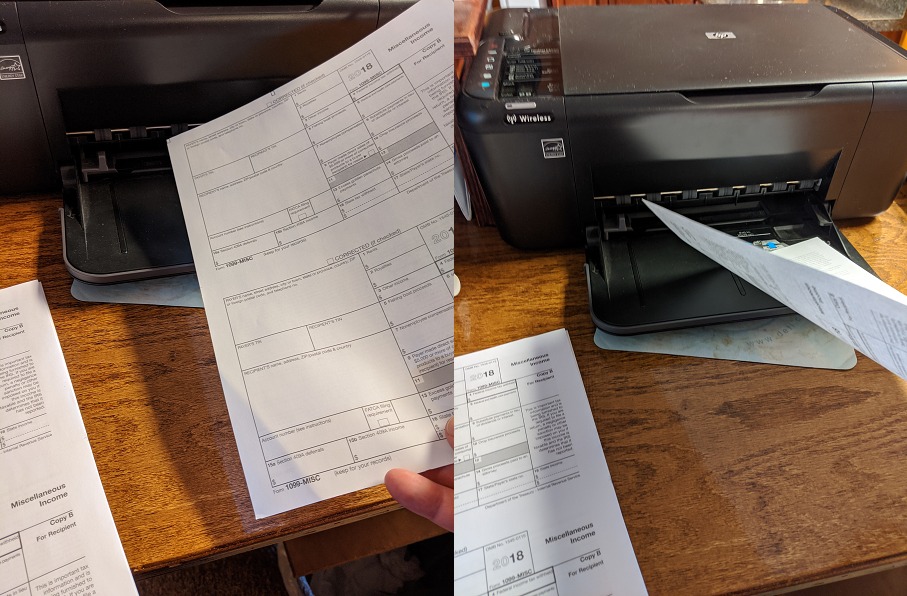

Once you've determined how to load the forms, pick up a stack and load them into your feeder tray.

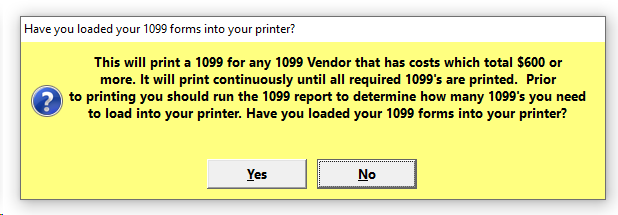

Click "Print 1099-MISC". Frazer will warn you in regards to what's about to happen:

Since we already verified our vendors and costs, we can click "Yes".

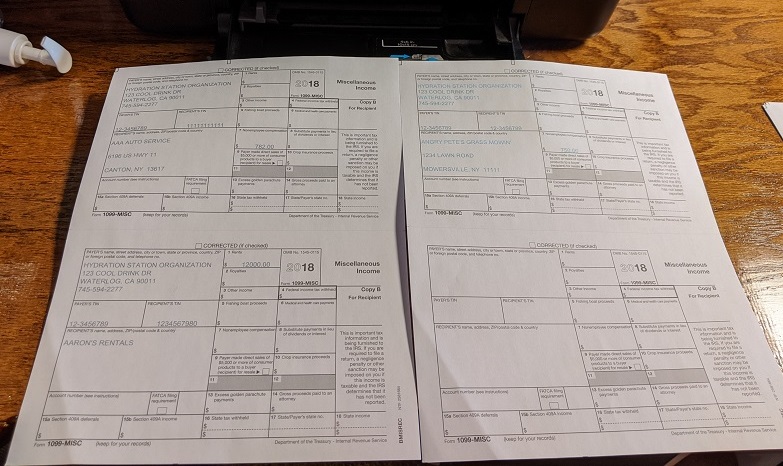

Frazer will then print out a stack of 1099s and fill in the appropriate fields and checkboxes on the pre-printed forms.

Loading the forms into the printer:

The finished product, ready to send out!

At this point, you're ready to print envelopes and send the 1099s on their way!

Frazer also provides the ability to print a 1096 form, which is basically a cover page for your 1099s.

The instructions for loading the pre-printed form are the same as printing 1099s. Once you've placed the 1096 into your printer's tray, you can print the form and submit it to the IRS in accordance with their instructions. You may keep a second copy for your records by printing the form again.